Together,

we can build a strong and sustainable Eastern Kentucky.

We are a nonprofit working toward an economy that is more diverse, sustainable, equitable and resilient.

Our Programs:

Storytelling & Policy

Read stories of great things happening in EKY and of the policy work we contribute to.

__ Learn More

Grow

We want business financing to work for you.

We are a Community Development Financial Institution and a nonprofit—not a bank. This means we can offer greater flexibility and lend to folks who may not otherwise qualify. We can also pay for all or a portion of a consulting project to help your business or organization succeed.

Sustain

We can help you save money.

The Mountain Association’s energy experts are tackling the problem of high energy bills in Eastern Kentucky. We help businesses, nonprofits, faith groups, local governments and homeowners find much-needed energy savings.

- Lee County Government

$20,000 / year in savings - Hemphill Community Center

$8,900 / year in savings - The Stafford family

$732 / year in savings

Succeed

Let’s grow your business.

Our Business Support program will pair you with consultants that can help your business or organization succeed. Together, you can share new ideas, answer questions and expand your impact.

- Business Coaching

- Financial Training & Planning

- Strategic Marketing

Learn

Bring your ideas to life.

Let’s talk about ideas you have for your town. Our Strategic Initiatives team can help you find resources and connect to others.

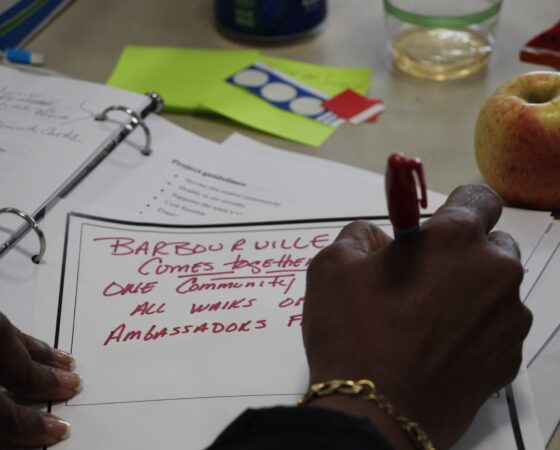

- Community Accelerator Program

- Collaborative Networks

- Demonstrations of Long-Term Investment in Change

Inspire

Learn how people are creating a new day in Eastern Kentucky, and how we can support your ideas.

Joyful Jams: Inclusive Music, Movement & Mindfulness

What are People Ready Communities?

Owsley County Organizers Take on Blight & Childcare

Get the Newsletter

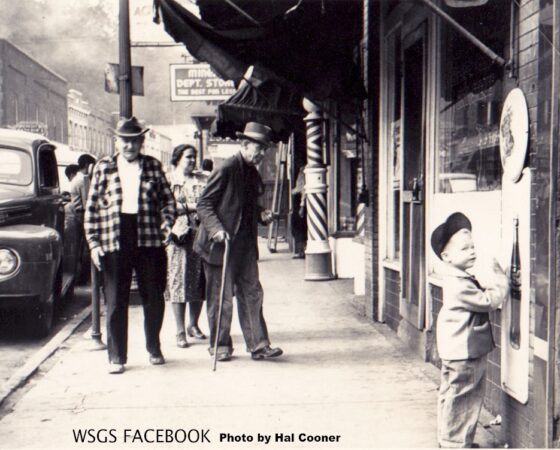

Downtown Hazard’s New Barber on Main Street

Shaping Clay & Community: Turtle Farm Pottery

How Trauma & Financial History Can Impact Aspiring Business Owners

Read How Trauma & Financial History Can Impact Aspiring Business Owners